Across Africa, the word 'debt' often makes headlines, and not for the right reasons. From mounting interest payments to stalled development projects, the continent has long carried the weight of expensive borrowing.

But a few countries are quietly rewriting that narrative.

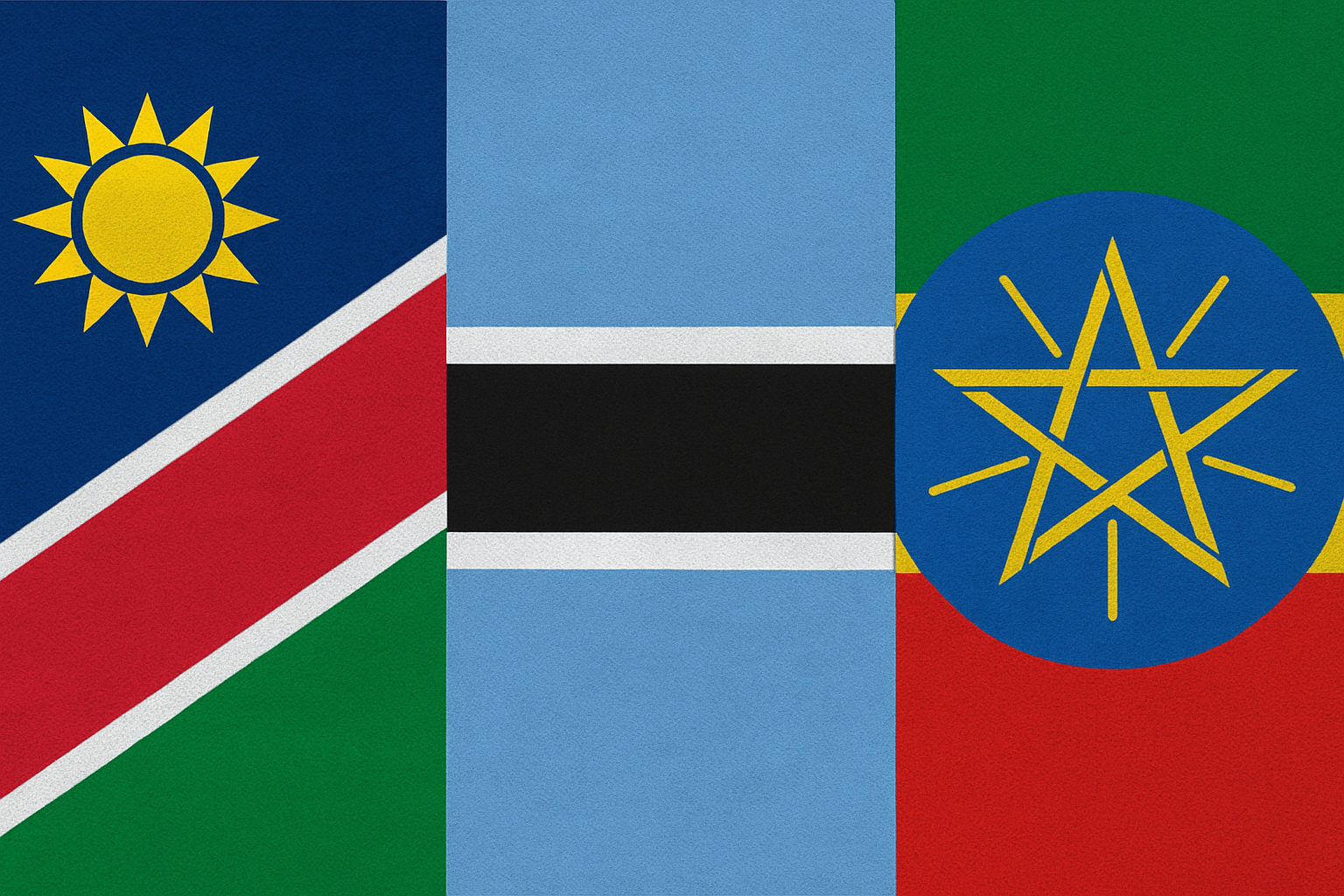

Namibia. Botswana. Ethiopia.

Three very different economies, yet all showing that it’s possible to grow even while cutting down on debt.

Namibia: Quiet Discipline Pays Off

In a historic move, Namibia has just executed one of the largest single-day debt repayments in its history: a US$750 million (€Eurobond issued in 2015), set to be settled at maturity this month. According to the central bank, the country has successfully mobilized the funds required. For ordinary Namibians, it means a government that can plan long-term without being squeezed by debt service costs.

Namibia has been tightening its belt in recent years, not through austerity, but through discipline. The government has slowed down new borrowing, focused on collecting more domestic revenue, and prioritized investments that actually deliver returns.

By managing debt sustainably, now below 65 per cent of GDP, Namibia has sent a message: fiscal health isn’t about saying no to loans; it’s about saying yes to the right ones.

That discipline is paying off. Investors are taking notice, and the country’s credit outlook is beginning to stabilize. For ordinary Namibians, it means a government that can plan long-term without being squeezed by debt service costs.

Botswana: The Power of Planning Ahead

Botswana’s story isn’t new, but it’s still powerful. Decades of cautious management of diamond revenues have made it one of Africa’s few countries with consistently low debt levels.

Even as global shocks hit from COVID-19 to commodity downturns, Botswana didn’t rush to borrow heavily. Instead, it tapped into savings and sovereign reserves, proving the value of building buffers during good times.

The lesson? Resilience starts before the storm. By saving when revenues were high, Botswana gave itself room to breathe when times got tough.

Ethiopia: Learning the Hard Way

Now, Ethiopia is shifting toward more private investment and export-driven projects, reducing reliance on expensive external loans. The country has benefited from US$3.5 billion in debt-service relief under the G20 Common Framework and is managing about US$8.4 billion of external public debt through restructuring agreements. The focus on producing and selling, not just building, is an important pivot for many African economies that borrowed heavily for infrastructure.

Ethiopia’s path has been tougher, but just as instructive. After years of ambitious borrowing to build railways, dams, and industrial parks, the government hit a turning point.

The debt grew heavy, and restructuring became unavoidable.

Now, Ethiopia is shifting toward more private investment and export-driven projects, reducing reliance on expensive external loans. The country’s focus on producing and selling, not just building, is an important pivot for many African economies that borrowed heavily for infrastructure.

The Bigger Picture: Africa’s Debt Wake-Up Call

What ties these stories together isn’t just fiscal management; it’s strategy.

Africa’s new challenge is not whether to borrow, but how and why.

Smart borrowing for projects that generate returns, like renewable energy, manufacturing, and technology, is the difference between debt as a burden and debt as a growth tool.

Countries that collect their revenues more effectively, plan ahead, and attract private capital can unlock development without drowning in loans.

Opportunities in the New Era

As more African nations rethink their debt, three big opportunities emerge:

-

Regional Investment Confidence:

Stable economies like Namibia and Botswana are magnets for investors seeking safe, predictable markets. Their fiscal discipline sets a benchmark for the region. -

Private Sector Partnerships:

Governments are realizing they don’t have to carry every project alone. From infrastructure to innovation, there’s room for joint ventures, blended finance, and public–private partnerships that spread risk and reward. -

A More Sustainable Growth Model:

The future isn’t about building fast; it’s about building smart. Countries that balance ambition with accountability are creating space for innovation, entrepreneurship, and homegrown financing solutions.

Africa’s Quiet Reset

There’s a quiet reset happening across Africa, one that doesn’t always make the news. It’s in the spreadsheets of finance ministries, the policies that protect currencies, and the choices that decide what kind of future each nation will build.

Namibia, Botswana, and Ethiopia remind us that managing debt isn’t about shrinking dreams; it’s about securing them.

Because Africa’s growth story doesn’t have to be borrowed.

It can be built.