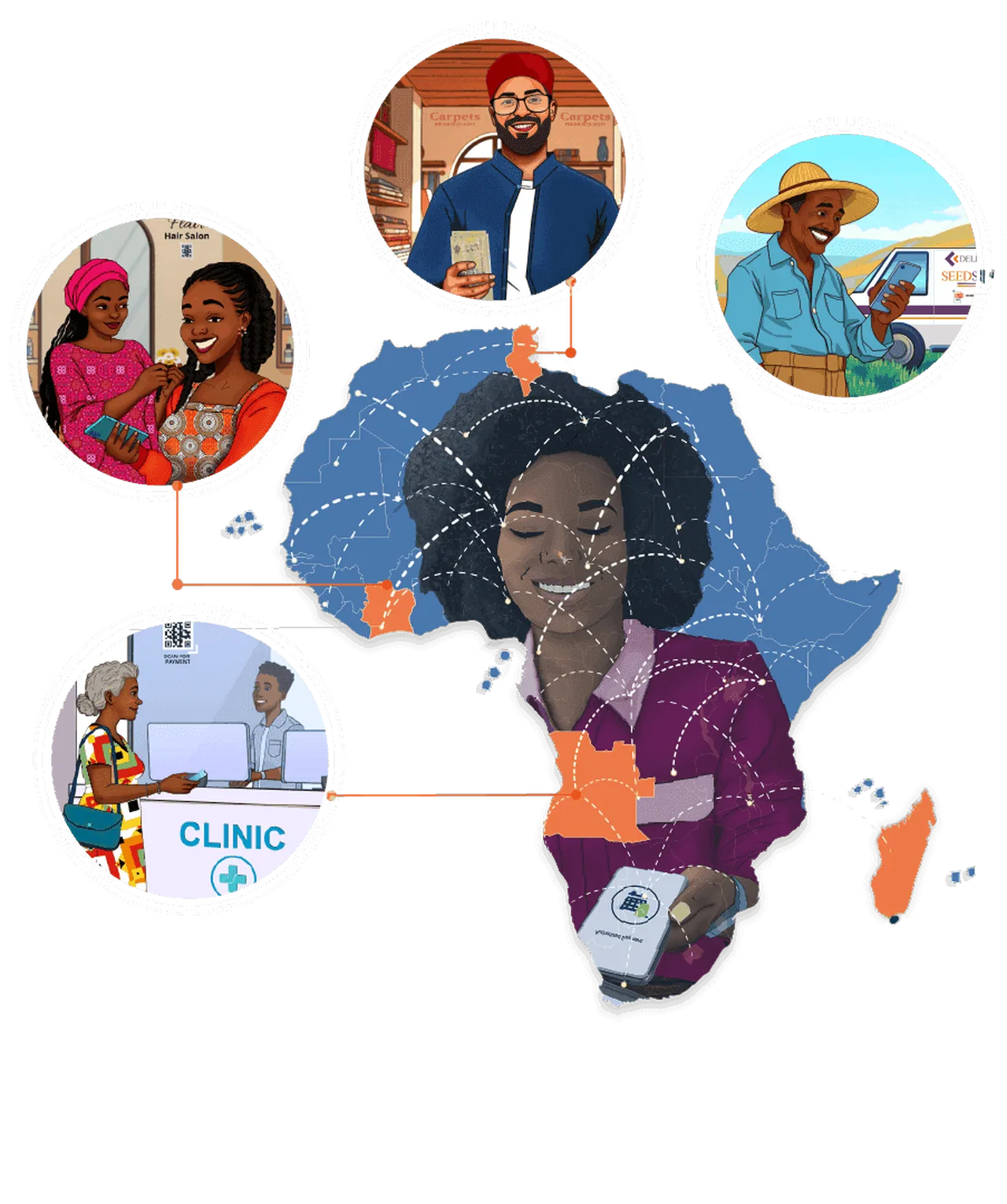

The just-released State of Inclusive Instant Payment Systems (SIIPS) 2025 report reveals extraordinary momentum in Africa's digital financial transformation, and we're only getting started.

The Big Picture

- 36 live instant payment systems across 31 African countries

- 64.6 billion transactions processed in 2024 (up from 19.7B in 2020)

- $1.98 trillion in transaction value

- 35% average annual growth rate since 2020

But here's what really excites me...

Historic Milestone Achieved

Nigeria's NIBSS Instant Payment (NIP) has become the first African IPS to achieve mature inclusivity - proving that world-class, inclusive payment infrastructure isn't just possible in Africa, it's happening RIGHT NOW.\

Three Insights That Stand Out:

1. The Cross-Domain Model is Winning

16 of 33 domestic systems now enable all-to-all interoperability between banks, mobile money operators, and fintechs. We're breaking down silos and building truly inclusive ecosystems.

2. Digital Public Infrastructure Mindset Shift

17 systems are now central bank-owned (up from 11 in 2024). Africa is treating payment systems as digital public infrastructure, like roads and utilities, prioritizing access over profit.

3. The Hybrid Reality

Even active digital payment users still need cash options. End-user research across 4 countries reveals that security concerns, network outages, and merchant acceptance gaps remain real barriers to adoption.

Regional Integration Taking Off

Three regional systems (GIMACPAY, PAPSS, TCIB) now connect 22 countries, with four more regional IPS in development. When fully operational, only 3 African territories will lack cross-border payment functionality.

What’s Next?

19 more domestic IPS are in development. The pace is accelerating - 5 new systems launched in the past year alone, the fastest deployment rate since tracking began in 2022.

The Bottom Line:

Beyond infrastructure, true inclusivity in Africa’s instant payment systems depends on making digital payments affordable, simple to use, widely accepted, and driven by collaboration among all stakeholders, making financial inclusion a reality and the future undeniably bright.

You can download the report here.